Typical loans let you borrow up to a particular amount with a credit score rating of 620 or larger. You must have a down payment of at the least three%.

Several lenders assign a loan coordinator to manual you thru the entire process of submitting your paperwork.

Lock in the house loan rate. When you’ve decided on a lender, receive a home loan price lock to protected your quoted interest charge.

A wonderful credit score could preserve you many hundred bucks a month on the $35,000 loan. Choose measures to boost your score like paying off revolving financial debt and stay away from opening a number of accounts at once.

How Does LendingTree Get Paid? LendingTree is compensated by companies on This page which compensation might effects how and exactly where gives appear on This page (like the buy). LendingTree isn't going to include things like all lenders, financial savings items, or loan alternatives available from the Market.

In the course of the mortgage loan software method, the bank will get an appraisal of the house. They want to verify its worth exceeds the level of the house loan loan.

Browse the small print Read through more than the main points of loans you happen to be thinking of, and commit a while digging into every one of the great print.

Our lowest costs can be obtained to buyers with the ideal credit rating. Quite a few factors are made use of to ascertain your amount, for instance your credit history heritage, application details and also the expression you select. Point out restrictions may possibly use.

→ Request a no-closing-Charge selection. You’ll trade a lower closing Value Monthly bill for a better interest level Should your lender offers a no-closing-Value refinance. The capture: You’ll devote much more on curiosity charges about the life of the property finance loan.

The cost distinction between the vendor’s acquisition selling price and the buyer’s price tag, as mentioned in the acquisition settlement.

Pick what feels finest to you — A very powerful factor is to succeed in out to a number of lenders, and you can more info start by browsing our top decisions for the most effective refinance lenders below.

Our information gurus ensure our topics are complete and Evidently display a depth of information over and above the rote.

“Composed” includes any copy of the written appraisal such as a electronic structure, which can be transmitted electronically, given that the transmission has the borrower’s consent and complies With all the provisions of your Electronic Signatures in Worldwide and Nationwide Commerce Act.

You might need to deliver ultimate files like paystubs, W-2s and bank account information and facts. As soon as you sign your paperwork, your resources will usually be immediately deposited into your account.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Andrea Barber Then & Now!

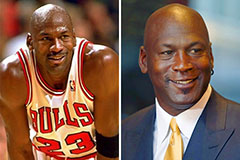

Andrea Barber Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!